When Alan McCarthy was sworn in as Cecil County Executive in December, I had more questions than answers on his plans for the county. Would he stay the course of the previous administration by keeping the county’s head barely above water, so focused on merely surviving that planning for the future almost seemed like an afterthought, or would he be a force for change?

In March, he announced his first budget and demonstrated that he was setting a course that would start moving the county forward.

Yes, the proposed budget includes tax increases but, for the first time in years, the budget is balanced and doesn’t rely on fund balance to do so. For nearly 20 years, the County had been depleting its savings to cover budgetary shortfalls. That ends with this budget–well, it could end with this budget, IF the Cecil County Council votes to accept Dr. McCarthy’s budget as proposed next week.

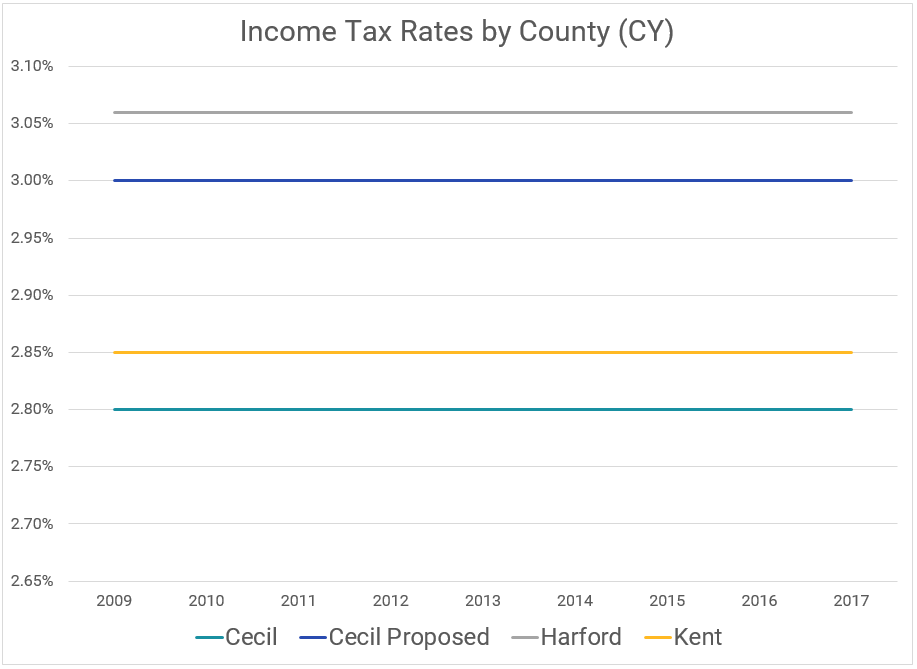

Proposed Cecil County Income Tax Rate

The proposed budget includes a .20 increase in the income tax rate to 3.00, which if approved, would be the first increase since 2001. The new rate remains inline with those of our in-state neighbors, Harford County and Kent County.

Few things are less expensive in 2017 than they were in 2001–actually, nothing is less expensive.

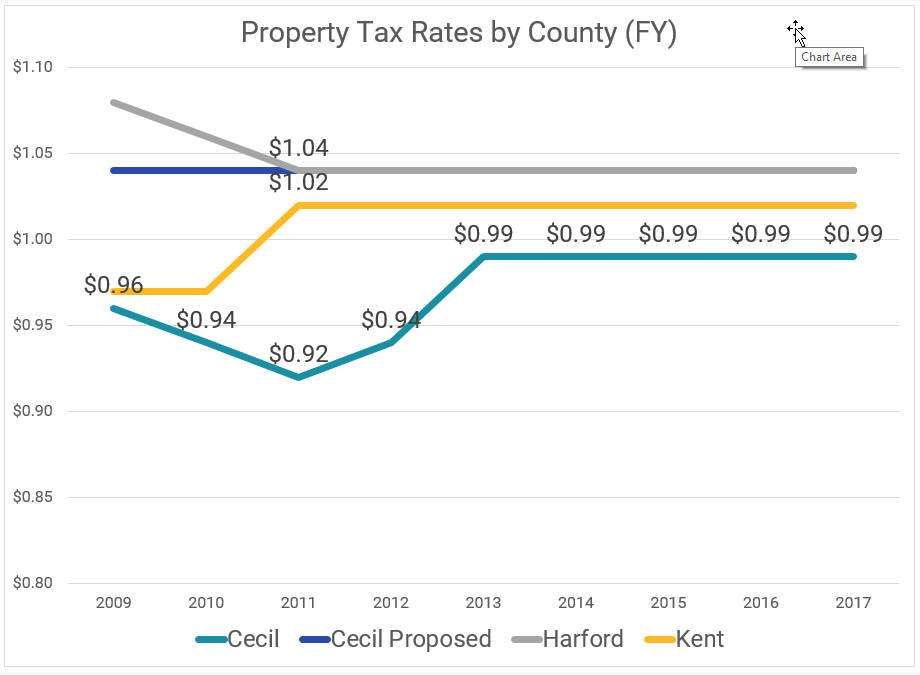

Proposed Cecil County Property Tax Rate

The proposed budget includes a .0500 increase in the property tax rate to 1.0414. Cecil County actually reduced its property tax rate during the recession and has remained level for the past five years and, even with this increase, remains inline with the rates in Harford and Kent Counties.

Changes in State Funding have Hurt Cecil County

Even if no other expenses in the county increased in recent years (a thought so preposterous that it’s laughable), funding decisions at the state level have hurt Cecil County.

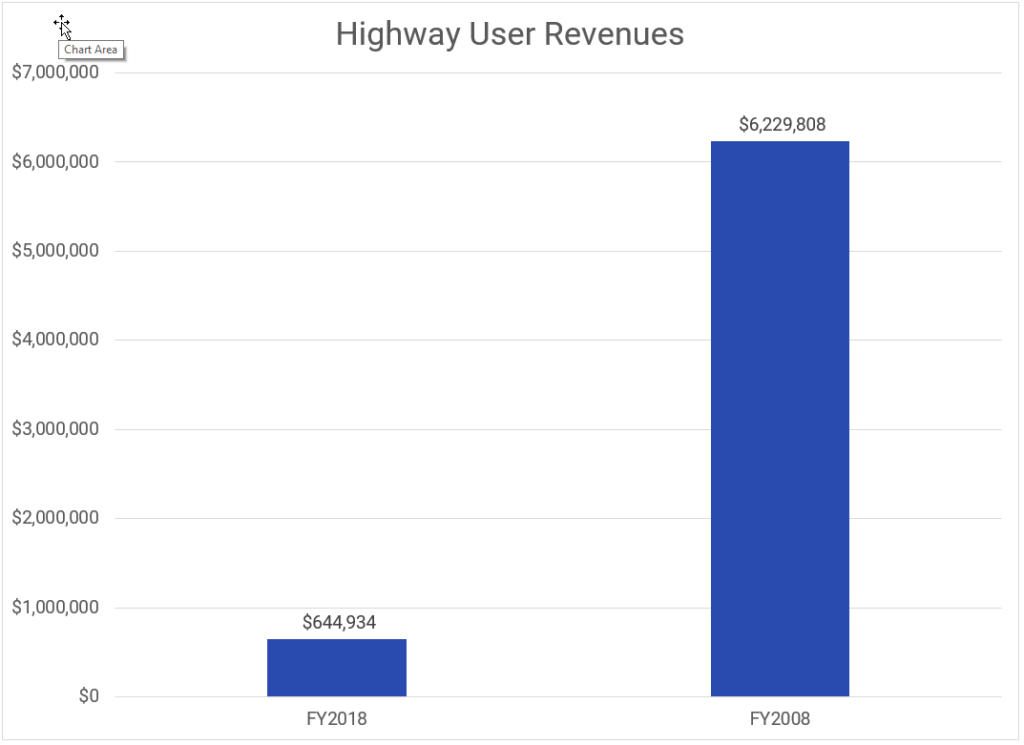

Highway User Revenues Cut

Each year, the state collects millions of dollars in tolls and gas taxes and, in the past, 30% of those funds were returned to the counties for the maintenance and repair of locally-owned roads and bridges. But in FY 2010, the state decided to reduce the portion returned to the counties to just 10%. At the county executive’s town hall on the budget in February, we were told Cecil County’s share of the highway user revenue plummeted from $6,229,808 in FY 2008 to just $644,934 for FY 2018 (projected).

So where do all those tolls the state of Maryland collects for the two bridges on the main roads into Cecil County end up? In the state’s accounts or on projects in other counties. How much money are we talking about? In FY 2016, $11.6 million in tolls were collected on the Thomas J. Hatem bridge that carries Rt. 40 over the Susquehanna River and $168.9 million in tolls were collected on the Millard E. Tydings bridge that carries I-95. Let those numbers sink in.

Regardless of the total collected, a pittance ends up coming back to Cecil County.

Teacher Pensions “Shifted”

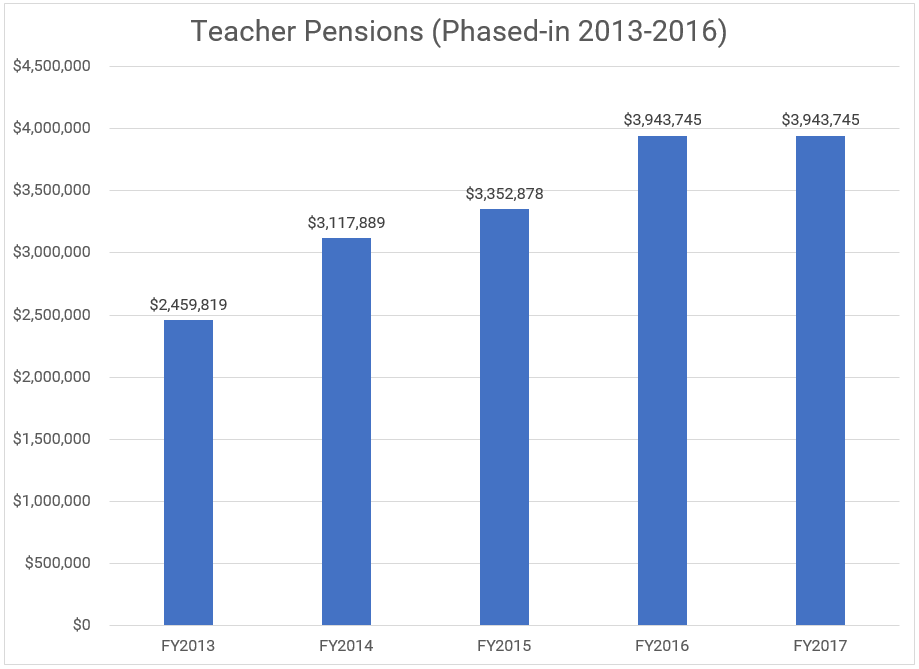

Not only did the state opt to slash the counties’ cut of the highway funds but they also chose to push the financial responsibility for teacher pensions, an expense that had historically be funded by the state down, to the counties. That expense of nearly $4 million per year was phased-in over the 2013-2016 fiscal years–while Cecil County, like most in the state, was still reeling from the recession. You can read more about the 2012 change here.

In summary, we’ve seen highway funds dry up and teacher pensions “shifted.” All the while, Cecil County did little to offset those crippling financial blows.

Ok, enough doom and gloom. Let’s talk about a bright spot of this budget cycle.

Agencies Advocating for the Greater Good

The spirit of this year’s budget conversations is different from those in the last few years. In the past, county agencies and supporters were pitted against each other in a battle for any available additional funds. But this year we’ve heard representatives from those agencies advocate for their own budget as a component of the overall proposed budget.

Speakers at last week’s budget hearing represented Cecil College, Cecil County Public Library, Cecil County Public Schools, Cecil County Emergency Services and emergency-related associations, and Cecil County Parks and Recreation and I’m sure a few groups I’ve forgotten who were all advocating for the budget as proposed. In a time when many are divided, it is refreshing to see these groups band together for the greater good.

That’s not to say there weren’t those speakers fighting against the budget and the necessary tax increases. From my tally, it was pretty evenly split with 20 speakers supporting the budget and 17 speaking against it.

That makes it even more important that the county council hear from us before they continue deliberations on Thursday and vote next Tuesday.

Contact the County Council Today

For too long, Cecil County has been trying to make do with less and we’ve just continued to dig ourselves a deeper hole. At some point, we will have to invest in our community. If we don’t start this year, when will we?

There is never a “good” time. We need to start now.

Be part of the solution. Email the county council to tell them you support the proposed budget. Copy and paste these email addresses jbowlsbey@ccgov.org, dschneckenburger@ccgov.org, gpatchell@ccgov.org, bmeffley@ccgov.org, jgregory@ccgov.org