Last week Cecil County Executive Alan McCarthy sat down for an interview with Cecil TV that should’ve shocked the county’s education advocates.

Unfortunately, only a few of us have seen it.

I didn’t share it on social media because additional facts needed to be included.

Transcript

[10:34] Cecil TV: So, Cecil County Public Schools is seeking a $6.4 million increase over their FYI 19 budget allocation and, and they’ve said that they would need more like 30 million to be on par with the state averages as far as

[11:04] McCarthy: The only way that we can keep up is basically for the county to find ways to generate new revenue. One of the problems is we brought lots of new businesses in, but because they’re in an enterprise zone, they do not generate the tax revenue which they really will anticipate after their time in the enterprise zone is basically expanded. For example, if you were to make a capital contribution wherever you do to improve the property, the county only collects 20% of that the first five years. That’s 25% 20%, per year for five years. And then we get 30%, 40%, 50% in a decreasing scale for them but beneficial for us. Right now we’re in the infancy of this program. So our revenues are not nearly what they will be in a brief 10 year time period.

[11:52] McCarthy: So, without that I don’t really know how we can get more revenue for the public schools because they’re growing their expenses at a far greater rate that we can grow the revenues.

[12:00] McCarthy: Right, even though they’ve tried to slash funding for example this year we’re basically flat, in terms of revenue. Last year we basically had three or four businesses that refinanced which basically provided to us about $3 million in extra revenue but there’s no guarantee and we can’t count on those things happening every year. So this year we’ll basically will have to

[12:36] Cecil TV: Right. So the county council was set to deliberate on March. Next

[12:44] McCarthy: Yes

[12:46] Cecil TV: How do you think that they will do it?

[14:48] McCarthy: I think it will be more aligned with me. I can’t promise what they’re going to do, but I would think that they would…a

Did he forget about the tax increase?

What?!? “$3 million in extra revenue” last year?!? The county’s own annual report noted that tax revenue increased $13.8 million in FY 2018 over 2017:

The revenues and transfers in for fiscal year 2018 increased $13,801,818 compared to the prior fiscal year. Primary factors in these results are:

- Property taxes were more than prior year by $7,681,046 primarily due tax rate increase of $.0500 from $0.9914 to $1.0414 as of July 1, 2017;

- Income taxes exceeded prior year by $1,295,428 – primarily due tax rate increase of $0.20 from $2.80 to $3.00 as of July 1, 2017;

- Real estate transfer taxes (recordation taxes and deed transfer fees) increased by $4,473,394;

Granted, that $13.8 million was included in the FY 2018 budget so they might not consider it “extra revenue,” but it is extra revenue all the same.

Check out this math: $13.8 million in tax revenue=$775,000 increase in the county’s “regular allocation” to CCPS in FY 2019

Where is that $13 million?

Somehow county officials keep “forgetting” to tell us where that additional tax revenue is going. It never seems to come up–it wasn’t mentioned at the county town hall on the budget or in this interview and I haven’t read about it anywhere. You think they’d be doing backflips to have the additional funds and shouting from the rooftops that they can finally restore funding to county departments, including the board of education.

But it was never mentioned.

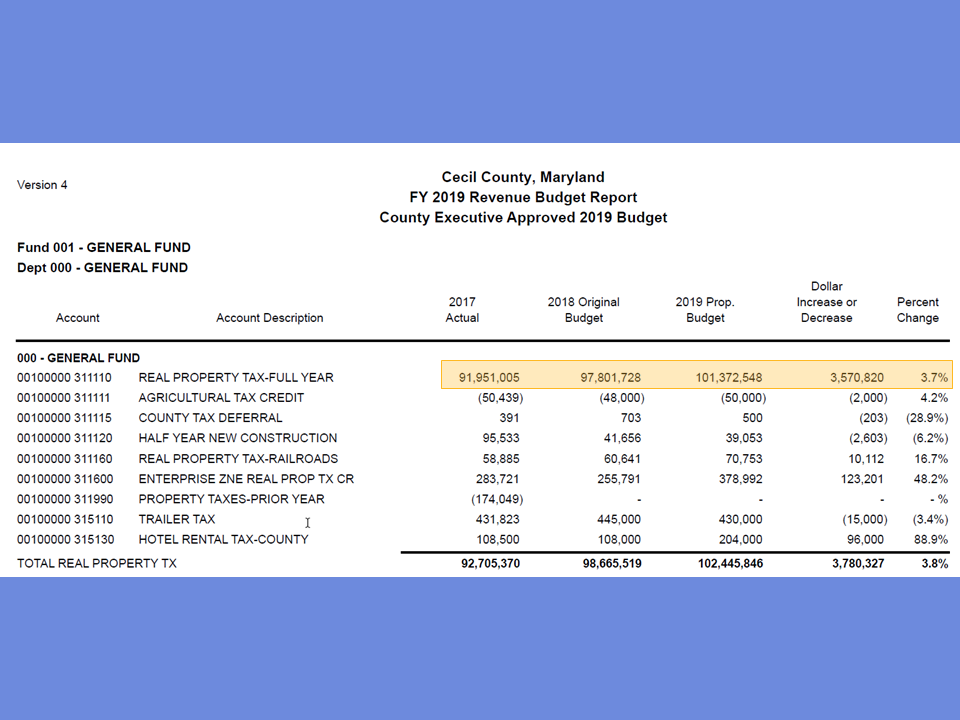

They didn’t decrease taxes for FY 2019, so while they might report that certain tax revenues are down this year compared to budget, that budget was significantly more than the revenue from FY 2017. Below is a snapshot of just the property tax budget:

Again, where is that additional tax revenue?

Is it in the county’s fund balance that we’ve heard so much about?

Nope. Well, at least it’s not in the line item that some talk about as fund balance:

Also from the county’s annual report for FY 2018: “Unassigned funds of $9,775,539

Let’s see:

- Almost $14 million in additional tax revenue in the first year of the tax increase

- Only $800,000 in additional spending on education

- “Fund balance” is down almost $500,000

- The higher tax rate continued in FY 2019

- And education is going to be “flat funded” in the second year of the tax increase?!?

It’s not too late–yet!

Email County Executive Alan McCarthy at [email protected] and Director of Administration Al Wein at [email protected] and tell them you want adequate education funding in the FY 2020 budget.

While you’re there, ask them if they’re up to date on the Kirwan Commission and its requirements for local education funding. Failure to fund specific initiatives like teacher salary increases and pre-K for all